EXECUTIVE SUMMARY

3

r

d

Ed I T I O

Sponsored by

A N

T

IO

N

BIS A L

C

A

N

N

A

INDUSTR

Y

A

S

S O C IA N T IO

T

h

e

C

a

n

nabisIndustr

y

.o

r

g

N

SPONSORS

GANNAS:RE

INSURANCE SERVICES

Denver Relief CONSULTING

CANNASURE

Cannasure Specializes in providing insurance products and Services to the legal cannabis industry. Cannasure was started with the singular purpose of helping the legal cannabis industry secure insurance products at a reasonable cost. Cannasures management team includes some of the top insurance experts and cannabis industry experts to create the first insurance company by and for the cannabis industry.

NATIONAL CANNABIS NDUSTRY ASSOCIATION

As the only national trade association for cannabis professionals, NCIA Works to defend and advance the industry on the national stage. The mission of the National Cannabis Industry Association is to promote the growth of a responsible and legitimate cannabis industry and to work for a favorable Social, economic and legal environment for that industry in the United States.

DENVER RELIEF CONSULTING

As the premiere cannabis consulting firm, Denver Relief Consulting offers a variety of services from licensing applications and compliance audits to effective cultivation techniques. The Denver Relief Consulting team provides custom Solutions for clients throughout all stages of business development. Denver Relief Consulting specializes in license application, facility design, post-license management, vendor relations, standard operating procedures and compliance.

This is only the Executive Summary Order the full 200+ page report at ArcViewMarketResearch.com

CANNAADVISORS

CanOpy

ADVANCED CANNABIS SOLUTIONS

© 2015 The ArcView Group

SPONSORS

CANNA ADVISORS

The Canna Advisors team has direct experience winning licenses, designing facilities and managing operations in the cannabis industry since 2009. As consultants, we have designed facilities and developed procedures for the most regulated markets across the nation, winning licenses in every state in which we have engaged.

CANOPYBOULDER

CanopyBoulder is a seed-stage, mentorship-driven business accelerator for companies developing ancillary products and Services for the broadening legal cannabis industry. CanopyBoulder will select 20 startups in 2015, invest 20,000 in seed capital in each venture, surround them With expert cannabis industry advisors, and invite them to Boulder to participate in a 12-week business boot camp to jumpstart their ideas.

OTHER SPONSORS

علهما

FREEDDM | ENTERPRısEs

Rx ReLeaf MJINEWS

MARIJUANA INVESTOR NEWS

Medicina

LETTER CREDITS

FROM

Publisher ArcView Market Research

THE PUBLISHER

Executive Editor Patrick Rea

Deputy Editor Carla Ooyen

Lead Researcher Kris Lotlikar

Associate Editor Connor Link

Graphic Designer Nancy McLaughlin

Associate Researcher Andrew Livingston

DEAR READER,

It is my pleasure to present to Contributing Editors Kris Krane Steve Berg Morgan Paxhia

you The Executive Summary of the 3rd Edition of the State of the Legal Marijuana Markets report. This will give you a solid glimpse of what we Contributing Researchers

elaborate on in much more detail in Nicholas Zettell

the full report. Frances Fu Vilmarie Narloch David Cosner Cassidy West Evan Nissan

In the last year, the rise of the cannabis industry went from an interesting cocktail conversation to being taken seriously as the fastest Jared Moffat

growing industry in America. What Shea Gunther

a remarkably fast transformation! At this point, it’s hard to imagine that any serious businessperson who is paying attention hasn’t spent some time thinking about the possibilities in this market.

At ArcView, we are proud to have

Published: January 26, 2015

been part of fueling and elevating that conversation. I can’t think of a single major national media outlet that has not mentioned ArcView’s research or interviewed one of our principals in its reporting on the cannabis industry This is only the Executive Summary.

in the last year. Order the full 200+ page report at: ArcViewMarketResearch.com

© 2015 ArcView Group © 2015 ArcView Group

Well-researched market data and serious, nuanced analysis is vital for entrepreneurs and investors to navigate these fast-growing, emerging markets. As the market leader in researching and understanding the legal sale and distribution of cannabis, ArcView Market Research brings unparalleled expertise and insight to the task. As the leading national network of investors looking to capitalize on the legalization of cannabis, The ArcView Group believes the investment in quality market data and analysis will pay dividends, not only for the investors and entrepreneurs in our network but also for the industry at large.

I hope this Executive Summary gives you a glimpse into the value that the full report offers for those serious about this industry. By purchasing the full report you are not only gaining access to the thinking of some of the best business minds in the space, but you are differentiating yourself in an industry where knowledge is power and a superior understanding

of market dynamics can separate winners from losers.

Similar caliber reports in other industries run $1,500 to $3,000, but we’ve priced our report at just $495, thus making it more accessible for individuals and not just businesses. You deserve to make decisions that are based on the best available data and insider analysis.

These are exciting times, and new millionaires and possibly billionaires are about to be made, while simultaneously society will become safer and freer.

At ArcView, we believe that the development of a responsible, politically engaged, and profitable, legal cannabis industry will hasten the day when not a single adult in the world is punished for this plant.

I look forward to working with you to build the next great American industry.

Sincerely,

Troy Dayton CEO The ArcView Group

A R C V I E W ’ S H I G H L I G H T S O F T H E L E G A L C A N N A B I S I N D U S T R Y

MEDICAL USE ADULT USE LEGISLATION LEGISLATION Adult Use 2012

Medical Use 1996-2000 Adult Use 2014

Medical Use 2001-2005 Adult Use 2015-2016 (projected)

Medical Use 2006-2010 Adult Use 2017-2020 (projected) No Adult Use Law

Medical Use 2011-2014 Medical Use 2015-2016 (projected)

80% No Medical Use Law

20%

Retail

Wholesale

$1.2 U.S. legal cannabis market gReW

BILLION RETAIL SALES from $1.5 billioN in 2013 to $2.7 billioN in 2014

2

States with active Adult Use 4 STATES + DC

Markets

with Adult Use Laws 14

States projected to

82% 18%

Medical Use

U.S. CANNABIS SALES IN TOP 5 STATES IN 2013 + 2014

Find the sales for all 14 active states in 2014 plus 2015/2016 projections in the full report

74% gRoWth iN 2014

adUlt Use

$2.7 BILLION TOTAL SALES $1,200 Million 2013 2014

$800 Million

1.5

M

$252

M

341% pURchaseRs

Washington’s

Nevada’s $400 Million

of legal

Projected Sales

gRoWth cannabis in

2014

iNcRease in

PASS new Adult Use Laws by 2020 $0 Million California Colorado Washington Arizona Michigan

“This report has been essential reading for me as an aid in crystallizing my investment strategy. It is the essential primer for anyone seriously interested in entrepreneurship and investment in this fascinating, explosive, rapidly evolving new industry.” — Steve Katz, New York State Assemblyman, 94th District

pRojectioN

for

2015

*Combined Retail and Wholesale Sales

2015

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

© 2015 ArcView Group © 2015 ArcView Group

TABLE OF CONTENTS FOR THE FULL REPORT

1. ExEcutivE Summary

2. mEthodology & acknowlEdgEmEntS

2.1. Acknowledgments

2.2. Methodology

2.3. Disclaimers and Other Information

2.4. Disclosures

3. national markEt

3.1. Overview

3.1.1. Current Market Legalization

3.1.2. Potential Market Legalization

3.1.3. National Market Growth Risk Factors

3.2. History of the Market

3.3. Addressable Market

3.3.1. Medical Use

3.3.2. Adult Use

3.4. Value Chain

3.4.1. Pricing Dynamics

3.5. Growth in Industry Participation

3.6. National Market Sentiment

3.7. National Advocacy

3.7.1. National Policy & Industry Groups

3.7.2. Trade Association Profile: NCIA, Michael Corriera

3.8. Regulatory & Legal Framework

3.8.1. Federal

3.8.2. Politician Profile: Representative Earl Blumenauer

3.8.3. States

3.8.4. Managing Business Legal Risk

3.8.5. Company Profile: GreenBridge Corporate Council, Khurshid Khoja

3.8.6. Legal Market vs. Black and Gray Markets

3.9. Product Regulation and Standards

4. StatE markEtS

4.1. Overview

4.2. Established Markets

4.2.1. Arizona

4.2.2. California

4.2.3. Colorado

4.2.4. Connecticut

4.2.5. Illinois

4.2.6. Maine

4.2.7. Massachusetts

4.2.8. Michigan

4.2.9. Nevada

4.2.10. New Jersey

4.2.11. New Mexico

4.2.12. Oregon

4.2.13. Rhode Island

4.2.14. Vermont

4.2.15. Washington

4.2.16. Company Profile: Trevor Steinthal,Suncliff

4.2.17. Washington DC

4.3. Emerging Markets

4.3.1 Alaska

4.3.2. Delaware

4.3.3. Hawaii

4.3.4. Maryland

4.3.5. Minnesota

4.3.6. Montana

4.3.7. New Hampshire

4.3.8. New York

4.4. CBD Only States

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

“With marijuana now legal for medical use in 23 states and Washington, D.C., and full legalization heading to the ballot in Alaska and Oregon, the size of the noncriminal marijuana industry is expected to grow to about $2.6 billion this year from about $1.5 billion last year, according to estimates by the ArcView Group, a marijuana research and investment firm in San Francisco.”

— The New York Times, “Next Gold Rush: Legal Marijuana Feeds Entrepreneurs’ Dreams” 7/22/14

© 2015 ArcView Group © 2015 ArcView Group

6. TABLE OF CONTENTS FOR THE FULL REPORT

ancillary BuSinESSES

6.1. Overview 5. markEt trEndS

6.2. Advisory Services 5.1. Alternative Ingestion Methods

6.2.1. Company Profile: Canna Advisors, Jay Czarkowski 5.1.1. Edibles

6.2.2. Company Profile: Bulbulyan Consulting Group, Avis Bulbulyan 5.1.2. Topicals

6.2.3. Company Profile: MJArdin, James Lowe 5.1.3. Extractions

6.3. Information Technology 5.1.4. Cannabidiol (CBD)

6.3.1. Consumer Facing 5.2. Product Testing

6.3.2. Business Management 5.2.1. Company Profile: CannLabs, Genifer Murray

6.3.3. Company Profile: Isaac Deiderich, MassRoots 5.3. Branding

6.3.4. Company Profile: Keith McCarty, Eaze 5.3.1. Company Profile: Luke Zimmerman, The Law Offices of Luke S. Zimmerman APC

6.3.5. Company Profile: Zachary Marburger, Cannabuild/Whaxy 5.4. Multistate Licensing

6.4. Insurance Services 5.4.1. Company Profile: Auntie Dolores, Julianna Corella

6.4.1. Company Profile: Cannasure Insurance, Pat McManamon 5.5. Reverse Mergers

6.5. Education 5.5.1. Company Profile:Tom Bollich, Surna

6.6. Other Ancillary Businesses 5.6. Changing Landscape of Cultivation

6.6.1. Security Services 5.6.1. Large Scale Production

6.6.2. Company Profile: Canna Security America, Dan Williams 5.6.2. Company Profile: Nick Hice, Denver Relief

6.6.3. Consumption Devices 5.7. Real Estate

6.6.4. Media 5.8. Cannatourism

6.6.5. Events 5.9. Growth in Nontraditional Consumers

7. invEStmEnt & FinancE 5.10. The Intersection of Advocacy and Entrepreneurship

7.1. Overview 5.11. Diversity in the Industry

7.2. Investment Types 5.11.1 Potential for Greater Diversity

7.3. Key Investment Considerations 5.11.2 Q&A with Women in the industry

7.3.1. Angel Investment 5.12. Consumer Education

7.3.1. Company Profile: ArcView Group 5.13. Lottery vs. Merit vs. Open

7.3.1. Individual Investor Profile: Lori Ferrara

7.3.2. Private Equity, Venture Capital Investment, and Hedge Funds

7.3.1. Company Profile: Dutchess Capital, Doug Leighton

7.3.2. Company Profile: Poseiden Asset Management: Morgan and Emily Paxhia

7.3.3. Public Markets

7.3.4. Banking and Finance

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

“ArcView Group, a San Francisco-based investor network focused on the cannabis industry, estimates that the national legal marijuana market will grow 64% to $2.34 billion in 2014 and will reach $10.2 billion in five years.” — Wall Street Journal “Entrepreneurs Seek Profits From Pot” 2/3/14

© 2015 ArcView Group © 2015 ArcView Group

EXECUTIVE SUMMARY IN 2014, THE LEGAL

cannabis industry

U.S.

CANNABIS SALES & GROWTH, 2011-2016E

expanded 74% to reach $2.7 billion in combined retail and wholesale sales, and firmly established itself as the fastest growing industry in America. 2014 will be remembered as the year that the legal cannabis industry became a consistent focal point for national media outlets and captured the public’s attention in a way that no other industry has in recent history. Five states now boast markets greater than $100 million, while one additional state posted sales above the $50 million mark. Legal Adult Use sales began for the first time in Colorado and Washington, adding $370 million in new sales dollars. voters in two more states and Washington, D.C., approved Adult Use measures, three states approved new medical use laws, and 11 states passed laws that allow for limited distribution of cannabidiol (CbD)

and exploration of medical cannabis. The editorial board of The New York Times products, a non-psychoactive but potentially medically

endorsed Adult Use legalization and launched useful component of cannabis.

an unprecedented multi-week series of

Colorado became the new epicenter of the

The full report, available via industry as the first active Adult Use market,

ArcViewMarketResearch.com takes a close

anti-prohibition articles. And prominent political and business personalities—such as California’s Lieutenant Governor Gavin and recorded $315 million in 2014 Adult

look at what happened in Washington and Use sales, for $805 million total combined

Colorado. It provides key insights and data retail (Adult and Medical) and wholesale

for any market participant who wants to learn

Newsom, former Mexican president Vicente Fox, and Virgin Group founder Sir Richard Branson—spent time in 2014 stumping for sales. Washington also successfully opened

from the first year of legal Adult Use cannabis. its Adult Use market mid-year and added

the legalization of cannabis.

$65 million in Adult Use sales. Both states

National polling on the issue consistently

On the heels of Colorado and Washington’s launched these markets with relatively few

shows clear majority support for Adult problems, which has led to a growing public

Use legalization, a trend buoyed by ringing acceptance of Adult Use legalization as a

endorsements from some of the most credible

early market success, Oregon, Alaska and the District of Columbia passed Adult Use legislation via ballot initiatives during the safe workable model with economic benefits

people and institutions in the United States. for the states that choose regulation over

In 2014, CNN’s chief medical correspondent

most recent mid-term elections. Maryland,

continued criminalization.

Dr. Sanjay Gupta broadcast two different one- hour specials dedicated to his endorsement

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

© 2015 ArcView Group © 2015 ArcView Group

“This report is a “must-have” for any serious investor, executive, or stakeholder in the legal marijuana space. ArcView’s report delivers on all fronts and is now a part of our investment process.” — Douglas Leighton, Dutchess Capital

New York and Minnesota passed new Medical Use laws in 2014, while states such as Nevada and Massachusetts took further steps to activate their markets by granting dispensary and cultivation licenses. 2014 was also a big year for more conservative states to sample the medical cannabis industry via CBD-only laws. Eleven states passed CBD- only laws in 2014, including Florida, Utah and Alabama.

The full report takes a close look at the regulations in each of these new state entrants to the market as well as an examination about how those regulations will impact the start and growth potential of each market.

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

Investment activity and business interest in the legal cannabis industry surged, with virtually every business-to-business event registering record attendance and unparalleled media interest. At the same time, The Department of Justice (DOJ) announced a policy shift aimed to encourage banks to accept cannabis-related business accounts, and Congress passed a law that prohibits the use of federal funds to prosecute people who follow their state’s medical cannabis laws. The DOJ also issued a memo in late December to allow Native American tribes to grow and sell marijuana within their territories as long as they follow established federal guidelines.

The industry suffered a few setbacks in 2014, but these were minimal compared to the market contraction and uncertainty that a much more nascent industry withstood in 2011 and 2012 as a result of various federal attacks and unfavorable industry press. Michigan once again failed to approve legislation to provide a dispensary structure to its medical cannabis law, and Florida’s landmark medical cannabis vote failed to pass the 60% supermajority test by a mere 2%. Montana continues to battle out the future of its medical market in its courts, and California’s regulatory structure continues to limit its market potential. Controversy over the license selection process has led to a delay in cannabis businesses opening in Massachusetts, while Illinois failed to meet its own deadline to approve dispensary and cultivation licenses. Though the DOJ attempted to give banks the go-ahead

to work with cannabis businesses, very few banks have followed through on the opportunity, so many finance issues persist in the absence of an official change to federal law. And in what legal experts consider to be an impractical move, Nebraska and Oklahoma filed suit against their neighboring state of Colorado, alleging that legal cannabis from Colorado floods their counties and taxes local law enforcement resources. On the tech front, many marijuana businesses have been prevented from establishing a strong online presence because of interference from large tech providers. Apple, for one, disallows most marijuana-related apps in its App Store, and Facebook decided in 2015 to close accounts that primarily post marijuana-related content on its main site or its photo-sharing app Instagram. This trend dramatically increases the relevance of dedicated cannabis social media and information providers.The biggest drawback for the industry is that cannabis remains illegal under federal law. The Drug Enforcement Agency still categorizes marijuana as a Schedule 1 controlled substance, which means the federal government considers it to be as dangerous as heroin, with no medical use and high potential for abuse. Nearly 700,000 people were arrested on cannabis charges in 2013 and thousands languish in prison with vastly disproportionate enforcement among the poor and people of color.

ArcView Market Research (AMR)—alongside many executives, investors, entrepreneurs and thought leaders interviewed for this report—

“The quality of content in the report shows that this group is clearly staying on the forefront of the industry.” — Emily Paxhia, Poseidon Asset Management

© 2015 ArcView Group © 2015 ArcView Group

believes that 2014 will be remembered as a year when industry experienced its most significant maturation to date and when a sense of inevitability about national legalization became conventional wisdom among elected officials and the general public.

The revolutions of 2014 did not go unnoticed by business leaders who may carry the industry into mainstream acceptance. Not two weeks into 2015, the Peter Thiel-led Founders Fund announced a multimillion-dollar investment in Privateer Holdings, an early industry venture capital fund that, among other deals, has signed with Bob Marley’s

$2.7

BILLION U.S. CANNABIS SALES BY STATE IN 2014

estate to launch a national cannabis brand called Marley Natural. The cannabis industry will become less fragmented as strong business leaders work together with advocacy groups and regulators to build strong regulatory structures, expand legal markets, and use critical investment dollars to support the development of market-leading brands.

2014 was a year full of bellwether moments and 2015 is expected to continue on the same path. But ArcView Market Research believes 2016 could be an even more significant year for the cannabis industry, cementing the industry’s rightful place

U.S. in the U.S. health, wellness and business

new laws and when each would pass. Market

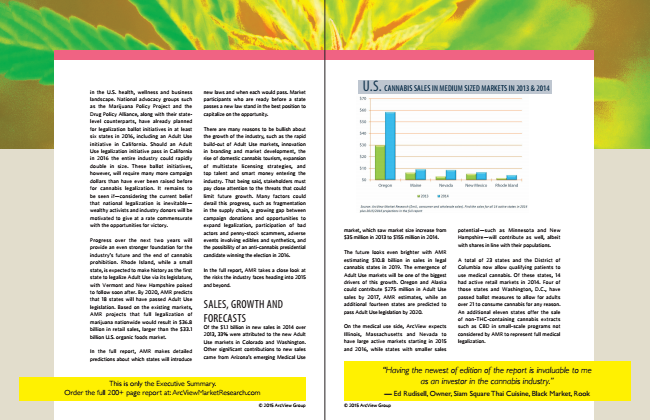

CANNABIS SALES IN MEDIUM SIZED MARKETS IN 2013 & 2014

landscape. National advocacy groups such

participants who are ready before a state as the Marijuana Policy Project and the

passes a new law stand in the best position to Drug Policy Alliance, along with their state-

capitalize on the opportunity. level counterparts, have already planned for legalization ballot initiatives in at least

There are many reasons to be bullish about six states in 2016, including an Adult Use

the growth of the industry, such as the rapid initiative in California. Should an Adult

build-out of Adult Use markets, innovation Use legalization initiative pass in California

in branding and market development, the in 2016 the entire industry could rapidly

rise of domestic cannabis tourism, expansion double in size. These ballot initiatives,

of multistate licensing strategies, and however, will require many more campaign

top talent and smart money entering the dollars than have ever been raised before

industry. That being said, stakeholders must for cannabis legalization. It remains to

pay close attention to the threats that could be seen if—considering the current belief

limit future growth. Many factors could that national legalization is inevitable—

derail this progress, such as fragmentation wealthy activists and industry donors will be

in the supply chain, a growing gap between motivated to give at a rate commensurate

campaign donations and opportunities to with the opportunities for victory.

expand legalization, participation of bad actors and penny-stock scammers, adverse Progress over the next two years will

events involving edibles and synthetics, and provide an even stronger foundation for the

the possibility of an anti-cannabis presidential industry’s future and the end of cannabis

candidate winning the election in 2016. prohibition. Rhode Island, while a small state, is expected to make history as the first

In the full report, AMR takes a close look at state to legalize Adult Use via its legislature,

the risks the industry faces heading into 2015 with Vermont and New Hampshire poised

and beyond. to follow soon after. By 2020, AMR predicts that 18 states will have passed Adult Use legislation. Based on the existing markets,

SALES, GROWTH AND AMR projects that full legalization of marijuana nationwide would result in $36.8 billion in retail sales, larger than the $33.1

© 2015 ArcView Group © 2015 ArcView Group FORECASTS Of the $1.1 billion in new sales in 2014 over

billion U.S. organic foods market.

2013, 33% were attributed to the new Adult Use markets in Colorado and Washington.

In the full report, AMR makes detailed

Other significant contributions to new sales

predictions about which states will introduce

came from Arizona’s emerging Medical Use

market, which saw market size increase from $35 million in 2013 to $155 million in 2014.

The future looks even brighter with AMR estimating $10.8 billion in sales in legal cannabis states in 2019. The emergence of Adult Use markets will be one of the biggest drivers of this growth. Oregon and Alaska could contribute $275 million in Adult Use sales by 2017, AMR estimates, while an additional fourteen states are predicted to pass Adult Use legislation by 2020.

On the medical use side, ArcView expects Illinois, Massachusetts and Nevada to have large active markets starting in 2015 and 2016, while states with smaller sales

potential—such as Minnesota and New Hampshire—will contribute as well, albeit with shares in line with their populations.

A total of 23 states and the District of Columbia now allow qualifying patients to use medical cannabis. Of these states, 14 had active retail markets in 2014. Four of those states and Washington, D.C., have passed ballot measures to allow for adults over 21 to consume cannabis for any reason. An additional eleven states offer the sale of non-THC-containing cannabis extracts such as CBD in small-scale programs not considered by AMR to represent full medical legalization.

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

“Having the newest of edition of the report is invaluable to me as an investor in the cannabis industry.” — Ed Rudisell, Owner, Siam Square Thai Cuisine, Black Market, Rook

NATIONAL PROGRESS On the national front, small changes continue to point toward a slow incremental federal exit from cannabis prohibition. In 2013, a memorandum from Deputy Attorney General James Cole formally set a pro-cannabis tone for the U.S. Department of Justice’s involvement in states’ jurisprudence over their own cannabis laws. Under the memo, prosecutors were guided not to base prosecutions on the size of commercial cannabis operations alone. Raids on dispensaries and grow operations dropped dramatically in 2014, suggesting that most in the federal government took the Cole Memo to heart. Then, in February 2014, guidance from the U.S. Treasury Department and the DOJ indicated that banks that offer financial services to cannabis based businesses in legalized states would not be punished if both the bank and its clients follow the basic business tenets set forth by the Cole Memo, as well as specific reporting requirements and due diligence expectations.

In the biggest federal win for the cannabis legalization movement in history, a rider in a December 2014 Congressional “cromnibus” spending bill passed and effectively eliminated the federal government’s fiscal capacity to interfere with states in their implementation and oversight of medical cannabis laws. The same spending bill, however, may impede the District of Columbia’s ability to enact Adult Use cannabis laws through much of 2015.

The continued success of the state markets has created the public perception that nationwide legalization is inevitable. This

trend—compounded with the loss of big name

one another and funding the greatest year

later in the year because of SEC actions and political donors, such as Peter Lewis and John

of expansion the legal cannabis industry has

a market that became wise to penny stock Sperling—has created a political funding crisis.

ever seen.

pump-and-dump schemes. In the full report, ArcView Market Research takes a closer look STATE MARKETS

Heavy investment activity has been directed

at the public stock roller coaster ride of 2014 to new dispensaries, commercial cultivation

to provide insights about what to look out for Each state market remains unique and

operations, manufacturers of infused

in 2015 as the industry matures. fractured, though certain regulatory trends

products, and ancillary products and services. have begun to emerge among newly regulated

In Colorado alone, industrial real estate is

Cannabis’s federal designation as a Schedule states. Lessons learned from the fast-growing

increasingly difficult to find, thanks to newly

1 drug remains the greatest barrier to and relatively efficiently regulated Adult Use

created (or expanding) cannabis businesses.

the entrance of institutional finance and market of Colorado have begun to inform the

investment groups in the cannabis industry. development of Adult Use and Medical Use

In the last two years, The ArcView Group,

In general, banks insured by the FDIC will not laws in newly opened states. Washington’s

the publisher of this report and the largest

lend openly to companies that profit from the adult use market—slightly more restrictive in

cannabis investment network, expanded its

plant for fear of federal repercussion. scope than Colorado’s—lags the Centennial

membership from 30 to over 400 accredited state by about one year, but it should provide

investor members who have invested more

“My company does tens of millions of dollars an instructive counterpoint in its regulatory

than $20 million into cannabis-related start-

of business a year and can’t get a $10,000 line scheme. Emerging markets in eastern states

ups. Also, non-cannabis investment events

of credit from a bank,” says Steve DeAngelo, favor regulatory and licensing structures used

began including programming about the

CEO of one of the largest medical cannabis in states such as Maine.

cannabis industry. Even CNBC’s popular

retailers, Harborside Health Center. segment Power Pitch has included some The largest medical market in the country,

cannabis-related start-ups.

Other challenges to investment include California, is no longer a model for medical

not-for-profit requirements in some states, cannabis legalization because of its lack of

In the full report, AMR takes a look at some of

ownership transfer limitations in others, statewide regulation. Arizona, on the other

the companies who have successfully raised

and in-state residency requirements and hand, will be the state to watch in 2015. Its

capital and the investors who have participated

disclosure requirements. market grew more than 300% last year—the

in these deals. AMR also examines the highest sales growth of any state in 2014.

different types of investment structures that

The lack of institutional capital available to have emerged in this unique market.

cannabis businesses that work directly with Sales and growth data and forecasts for 2015

the plant has created opportunities for the and 2016 are available for all active states in

The public markets saw a massive influx of

hundreds of individual investors and smaller the full report.

companies that seek to capitalize on investor

venture funds making inroads to cannabis. interest in the new sector. The number of

Some of these same investors play in ancillary FINANCE & INVESTMENT

public cannabis companies skyrocketed at

products and services. the beginning of 2014 and then plummeted Federal prohibition has not slowed investment interest in cannabis. Financiers and entrepreneurs have succeeded in finding

“I find this report absolutely invaluable. The breadth of coverage of multiple market segments and insights

This is only the Executive Summary. Order the full 200+ page report at: ArcViewMarketResearch.com

into geographically specific issues will support very focused targeting and analysis of opportunities.” — Steve Trenk, Lizada Capital

© 2015 ArcView Group © 2015 ArcView Group